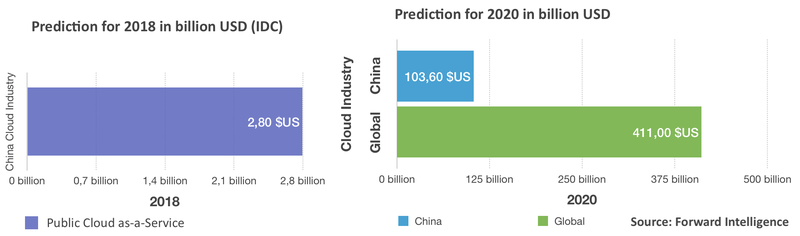

The global market of public cloud services is expected to reach a staggering $186.4 billion this 2018, a 21% growth from last year according to Garner, an American research firm. China is no exception to this rise with a dynamic market seen to be the largest for public cloud services in the Asia Pacific (except Japan) this 2018:

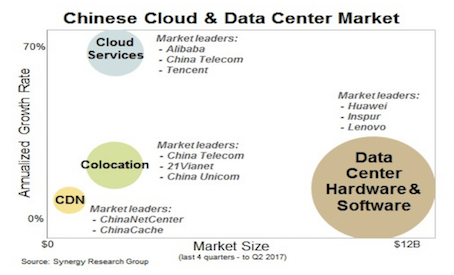

Overall, Chinese firms are dominating the market. They are leaders in each of the four key market segments: data center hardware/software, cloud computing services, colocation and CDN.

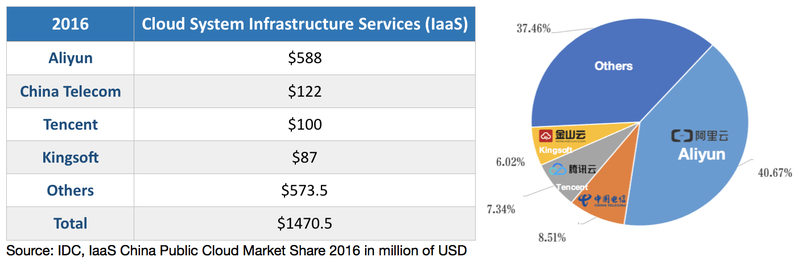

In 2016, the Infrastructure-as-a-Service is estimated to reach almost $1.5 billion US dollar. Alibaba Cloud was the leader in the Chinese public cloud market (IaaS) with a share of over 40% just itself far ahead of others main providers who are competing to fill the top 3 position:

The regulative market of China has spared the local companies from direct competition of global heavyweights which allows them to rise calmly. They are now attempting to reach new markets outside of China but only Alibaba Cloud has made a significant move in building a name in the global market with an investment of 1 billion USD in 2015 for global expansion.

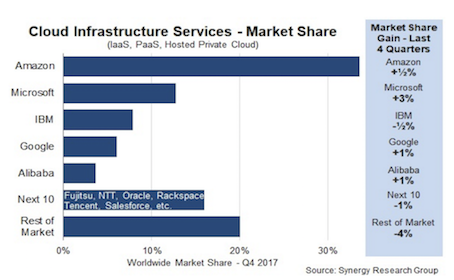

Alibaba Cloud branch experienced huge growth and announced a 533$ million in revenue for its Q3 earnings, a 104% increase from last year. It recently ranked 5th in the Cloud Infrastructure Market Share report enjoying between 3% and 4% of global market share.

Despite the significant gap with the leader Amazon, it is noticeable that Alibaba is no longer lumped among the Next 10 but is instead considerate as a main player.

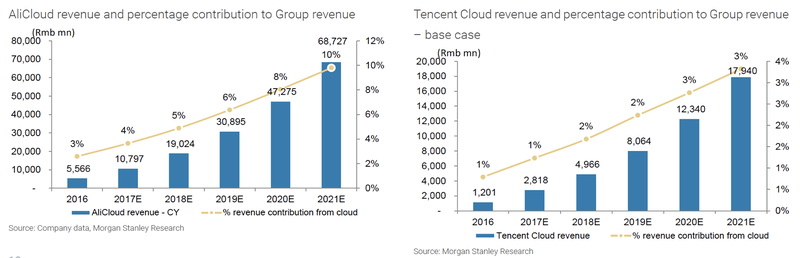

Alibaba and Tencent account for nearly half of the market share and are predicted to keep the big pie for the next 3 years. Their revenues will also rise steadily reaching over $10.5 billion for AliCloud and $2.8 billion for Tencent, accounting 10% and 3% of their global revenue respectively compare to their current 3% and 1%.

As Chinese companies are trying to go global, meanwhile global firms mostly from the US are also targeting the huge market opportunity of China as even small shares in the market can lead to huge revenue number.

Among top foreign companies, a survey from Morgan Stanley shows that IBM, Amazon Web Services (AWS) and Microsoft's Azure are the 3 main providers of public cloud in mainland China. IBM stands out in public cloud, ahead of others supposedly due to its role as a supplier of mainframe and related software to major Chinese companies and government agencies.

Overall, we can notice the top 4 firms share over 62% of the whole market and 80% of the revenue goes to local companies which leaves little to the others. Nevertheless, foreign companies are eager to operate in the Chinese market despite the little prize to share and the steep price for doing business in China. All global international cloud providers must cooperate with domestic service providers or technology licensing to operate in China. As a result of the regulation:

China still has a complex regulatory environment with intense local competition. However, the market opportunity is such attractive to a point foreign firms are willing to invest heavily in the cloud sector and take necessary measures to be compliant. Massive investments from both public and private actors also support this trends as it enables higher speed connection in remote area and better wireless connectivity in the whole country which enhance the rising cloud adoption in China.